|

Trailing management (DOMTrader)

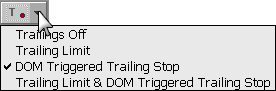

Trade trailing limits or stops using this menu.

Trailing limit orders track the market and automatically adjust the price level position in the exchange’s order book. For a buy order, as the best bid/offer/trade (depending on your settings) moves up, your order moves up with it based on the trailing offset. When the best bid/trade/offer trade moves down, your order holds. When the best bid/offer/trade matches your order price, the order executes.

Trailing stop and stop limit orders adjust their trigger price in concert to the direction of the market on a tick-by-tick basis, initially trailing the market with the same distance to the market price when the order is first placed. The trigger price of a trailing sell stop order automatically steps higher with the market for each up tick, but does not step lower.

You must be enabled for these “smart order” types.

|

CQG |